Across Europe’s northeastern flank, a new kind of border infrastructure is taking shape. Less concrete and concertina wire, more antennas and algorithms, it is designed to surveil and tame the “lower airspace” where cheap quadcopters and fast FPV platforms now decide outcomes from prisons to battlefields. At the centre of this shift sits Sensofusion, a Finnish counter‑UAS specialist whose Airfence platform has travelled a telling trajectory, from protecting parliaments and airports to hard lessons on the Ukrainian front, and now towards pan‑regional architectures often described as a European “drone wall”.

The Nordic dual‑use arc

The Nordics have excelled at “dual‑use” technologies, civil innovations readily repurposed for defence. Sensofusion epitomises the pattern: an RF (radio‑frequency) detection stack first tuned for civilian sites and law enforcement, then adapted to contested environments where drones spoof, swarm and manoeuvre without emissions. The company is firmly rooted in Finland’s defence‑electronics tradition, but it also reflects the Nordic venture playbook: export‑driven, small‑team agility, and tight feedback loops with demanding public‑sector users.

The strategic driver is clear. Since 2022, the war in Ukraine has normalised persistent drone presence, from consumer quadcopters dropping munitions to long‑range reconnaissance wings and loitering munitions. As Mikko Hyppönen, the veteran cybersecurity leader who joined Sensofusion as CRO in 2025, has argued publicly, the decisive contest is shifting from heavy armour to control of the lower airspace. His appointment underlined the convergence of cyber and RF tradecraft in counter‑UAS, and signalled Sensofusion’s intent to scale R&D for a fast‑adapting threat.

What Airfence does

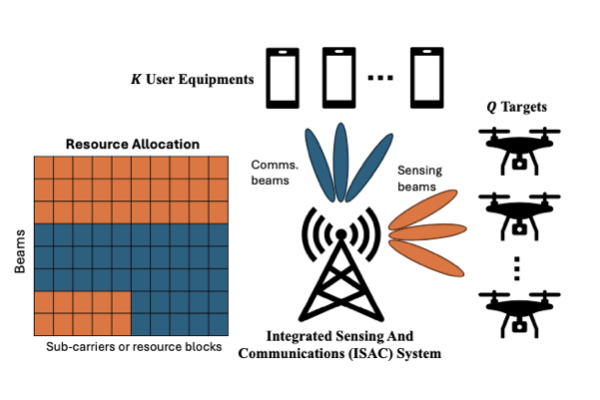

Airfence 7 is a passive RF detection and response system that locates both drone and pilot in real time, exposing additional telemetry such as home point and serial number for many commercial platforms (notably the DJI family). “Passive” matters: it listens rather than transmits, making it harder to target while remaining compliant in sensitive RF environments. A single unit can cover up to 10 km line‑of‑sight, with coverage scaling via networked sensors. The field UI is a web application with live mapping, historical detections, and alerting; deployments can run offline (sensor‑hosted UI) or across cloud/closed networks.

What’s changed since early Airfence releases is layering. Sensofusion now markets extensions that fuse KELA (a high‑gain direction‑finding antenna) with optional radar, a next‑gen optical perimeter system (event‑camera tech able to track extremely fast objects), and even a satellite‑awareness feature that flags possible SAR observation. The effect is a hybrid passive‑plus‑active picture: RF tells you who and where; radar and optics tell you what, how fast, and with what kinetic profile; satellite cues tell you who might be watching.

For militaries, a Military Edition supports a broader set of countermeasures (e.g., jamming/spoofing) that, by design, are not part of the Standard Edition used in civilian contexts.

In 2026, credible counter‑UAS is no longer a single sensor or a single kill‑switch. It is a stack: passive RF + DF, supplemented by radar and high‑speed optics, wrapped in C2 software that is fast, explainable, and export‑compliant.

From prisons and parliaments to trenches and borders

- Critical infrastructure & urban venues: Airports, government campuses and energy sites require non‑emitting detection with clear adjudication workflows. Airfence’s passive approach and browser UI suit operators who need to log serials, correlate pilots, and escalate without radiating.

- Corrections: Smuggling via quadcopters forced early adoption of RF geofencing and pilot tracing; passive DF helps attribution and interdiction without violating spectrum rules.

- Battlefield: Ukraine accelerated demand for robust, mobile deployments and countermeasure‑capable variants. Sensofusion’s pivot to a military focus is reflected in messaging and partnerships, and in fielded learnings about FPV densities, emission‑controlled drones, and dynamic EW conditions.

- Borders (“drone wall”): The Baltics’ conceptual “drone wall” aims to integrate detection, ID and, where lawful, interdiction across national seams. Finnish coverage has spotlighted Sensofusion as a potential contributor, citing long‑range detection claims and prior USMC contracts as credibility markers. The “drone wall” is still a policy and procurement journey, but the architecture aligns with Airfence’s multi‑node, layered design.

Inside the box and on the mast

Deployment is deliberately pragmatic: the sensor unit, DF antenna, PSU and network device ship in a rugged wheeled case (≈25 kg). Connect power, antenna and network to mil‑grade ports; the system hardens for –30°C to +50°C, with sealed cooling strategies for dust and water ingress. KELA ups the gain for longer reach; radar and optical add‑ons lift update rates and non‑RF detection. Mobile kits fit vehicle roofs; covert antennas enable low‑profile urban work.

Senso C2 provides the operator picture and can stitch detections across sensors and sites. While Sensofusion keeps some UI details close, the company emphasises over‑the‑air detection‑library updates and cloud or closed‑loop configurations depending on mission and security needs.

A Finnish scale‑up in a sharpening market

Sensofusion positions itself as combat‑proven and export‑oriented, with a footprint of governmental customers across Europe, North America, the Middle East and Asia. Public‑facing materials emphasise pre‑qualification and a refusal to sell to EU‑sanctioned organisations, an important signalling point in today’s compliance climate. Growth has tracked global demand for C‑UAS, and Nordic/European press and databases now list the company among Finland’s leaders in the segment.

Media coverage in 2025–26 highlights three strands:

- Leadership moves (Hyppönen joining as CRO in June 2025, bringing cybersecurity gravitas and global visibility).

- Operational credibility (migration from civil sites to battlefield use‑cases following Russia’s full‑scale invasion).

- Border‑security relevance (commentary on a potential role in the Baltic‑led “drone wall” concept and the realities of cross‑border sensor networks).

In Finland’s defence‑tech ecosystem, Sensofusion sits alongside larger primes and RF/EW specialists (e.g., Patria, DA‑Group) but carves a niche in passive RF detection + layered extensions rather than traditional radar‑first solutions, useful in spectrum‑restricted sites and for attribution workflows.

Exports, sanctions and the ethics of lower‑airspace control

Exporting counter‑UAS is not a simple commercial act, it’s a compliance regime. Sensofusion’s site is explicit: no dealings with EU‑sanctioned entities and pre‑qualification via official email to vet buyers and end‑uses. This mirrors a broader EU posture seeking to tighten controls on dual‑use tech while enabling allies to harden lower‑airspace. In practice, that means complex end‑user certificates, potential geo‑fencing of features, and growing expectations for audit logs in C2 software.

The “drone wall” proposition adds another policy layer: interoperability across jurisdictions, cross‑border data sharing, and clear ROE (rules of engagement) for active countermeasures, especially where jamming/spoofing could spill over into civil bands. Passive detection and multi‑sensor corroboration help, even before any kinetic or RF denial is authorised.

Ukraine’s lesson – speed, swarms and signatures

Ukraine taught European planners three uncomfortable truths. First, the cheapest drones often produce the most strategic friction, making cost‑per‑intercept a core metric. Second, signatures are malleable: adversaries will dampen emissions, shift bands, or shift to fibre‑optic FPV links to evade RF detection. Third, swarms and saturation must be assumed, not treated as edge cases. Sensofusion’s answer has been to push DF gain (KELA), diversify with radar and event‑camera optics, and keep the detection library current, a cyber‑EW style “cat and mouse” game Hyppönen knows well.

Where Sensofusion fits in an EU “drone wall”

If the wall is a federated mesh of fixed and mobile nodes, Airfence offers several advantages: passive first for compliance and survivability; plug‑and‑play deployment to thicken coverage quickly; and extensions to add radar/optics where RF‑silent threats are expected. The open question is command‑layer unification across member states, how Senso C2 (or equivalents) federate, who owns the data, and how alerting escalates to interdiction authorities in near‑real time. Those are procurement and governance decisions as much as technical ones, but they will decide whether Europe’s drone wall is an architecture or just a slogan.

Risks and open challenges

- Emission‑controlled drones: RF‑silent profiles force heavier reliance on radar and event‑camera correlations; this makes sensor placement and terrain masking critical.

- Legal authority for effects: Many jurisdictions still lack clear frameworks for active countermeasures outside military perimeters; vendors must maintain detection‑only pathways for civil deployments.

- Supply‑chain and export latency: Sanctions screening and end‑use assurances can extend lead times; however, they are now essential for European legitimacy in sensitive markets.

Outlook: the lower‑airspace OS

By late 2026, expect European border forces and critical‑infrastructure operators to treat lower‑airspace control less as point protection and more as an operating system: federated sensors, shared tracks, policy‑driven effects, and continuous library updates. Sensofusion’s bet, that a passive core augmented by selective active layers is the most exportable and sustainable architecture, aligns with that trajectory. Whether building a “drone wall” or just hardening a single airport, the premium will be on signal intelligence, attribution, and speed of decision, not on any single “silver bullet” jammer.

Airfence at a glance

- Core function: Passive RF detection, real‑time location of drone and pilot, with metadata (home point, serial) for major commercial UAVs.

- Range: Up to 10 km per sensor (LOS), scalable via multi‑sensor networking.

- Operating modes: Offline (sensor‑hosted UI) or cloud/closed loop; browser‑based UI with history and alerting.

- Ruggedisation: –30 °C to +50 °C; weather‑sealed; rapid rooftop/vehicle deployment.

- Price point (public site): €160,000 + taxes (sensor + DF antenna + software).

- Extensions: KELA DF antenna; radar integration; event‑camera optical system (high‑speed, night‑capable); satellite‑awareness for SAR cues.

- Policy stance: Pre‑qualification required; no sales to EU‑sanctioned entities.

From civil security to contested airspace

- 2017: Public milestone with Airfence 5.0 launch, direction finding and ruggedisation push the platform towards harsher environments.

- 2018–2021: Trials and collaborations with European and US defence and aviation stakeholders build operational pedigree (as referenced in historic press).

- 2022–2024: War in Ukraine shifts market demand; vendors prioritise mobile, jam‑resilient, and attribution‑capable systems.

- June 2025: Mikko Hyppönen joins as CRO, signalling a deeper cyber‑EW fusion in R&D and evangelism.

- 2026: Airfence 7 detailed publicly with KELA, radar/optical extensions, and export‑compliant procurement pathways; European discourse turns to a federated “drone wall”.

Sources and further reading

- Company/product: Anti‑drone system | Sensofusion; Airfence 7 product page; Extensions (KELA, radar, optics, satellite).

- Leadership & context: SecurityWeek: Hyppönen joins Sensofusion (June 2025); TechDigest interview/feature (Jan 2026).

- Ecosystem & “drone wall”: Yrittäjät coverage of Finland’s role and the Baltic initiative; Finnish anti‑drone landscape listings.

Photo: Sensofusion Ltd