🇸🇪 Sweden

1) Ericsson + Nokia + Fraunhofer show 6G video coding

First live demo for next-gen codec over 5G/6G network.

Step toward immersive comms at 6G latencies.

Multi-vendor R&D milestone.

Source: Ericsson, 27 Oct 2025. Chalmers University of Technology

2) Ericsson & Vodafone five-year “programmable networks” pact

Co-create AI-driven, API-exposed network services.

Targets faster service rollout and automation.

UK-Nordic innovation corridor.

Source: Ericsson, 16 Oct 2025. Lund University

3) Saab wins U.S. Army Giraffe 1X radar order (~$46 m)

C-UAS/air-defense systems deliveries start 2026.

Expands export footprint for compact radars.

Backlog strength continues.

Source: Saab, Oct 2025. Start

4) Saab: Spanish Arthur radar life-extension (~SEK 540 m)

NSPA contract for Spanish Army.

Sustainment + upgrades through 2026–.

European radar base reinforced.

Source: Saab, 20 Oct 2025. Start

5) Saab: Additional order for A26 submarines (SEK 9.6 bn)

Final production phase + extra scope for two boats.

Deliveries 2026–2032.

Blue-water industrial capacity secured.

Source: Saab, Oct 2025. Start

6) Volvo Cars: EX60 multi-adaptive safety belt cited by TIME

New restraint system named Best Inventions 2025.

Debuts on upcoming EX60.

Brand-defining safety innovation.

Source: Volvo, 9 Oct 2025. Volvo Cars

7) Scania opens Rugao industrial hub (China)

Local build + innovation for heavy transport.

Dual offering incl. China-specific NEXT ERA.

Exports start late 2025.

Source: Scania, 15 Oct 2025. Scania Corporate website

8) Chalmers: titanium + vanadium discovery in hydrothermal fluids

New insights into metal transport/deposition.

Impacts critical minerals sourcing.

Research published Oct 2025.

Source: Chalmers, 10 Oct 2025. Chalmers University of Technology

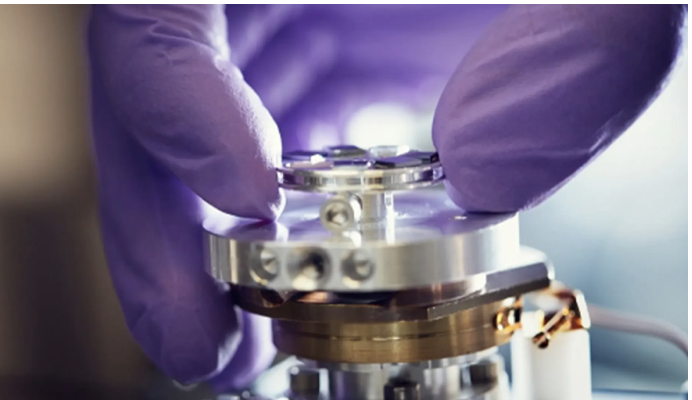

9) Sweden–Singapore Quantum Innovation boosting chips/AI

Chalmers & NUS strengthen quantum tech links.

Focus on photonics/compute cross-over.

Nordic-Asia R&D bridge.

Source: Chalmers, 8 Oct 2025. Staff Lund University

10) Sifted: Sweden’s AI-native startups triple funding (YTD)

€454 m across 28 deals; October spike.

Momentum from Legora/Lovable raises.

Ecosystem tailwinds.

Source: Sifted, 5 Nov 2025 (covers Oct trend). Sifted